Changes to Required Minimum Distribution Starting Age

Some people will be able to postpone taking Required Minimum Distributions (RMDs) to a later date. Once we reach a certain age, we must begin taking distributions from our retirement accounts, such as IRAs, 401(k)s, and 403(b)s. The amount of these distributions is determined by a specific calculation that takes into account our age and the total balance of the account. Generally, the older we get, the larger these distributions get so that the account is as close to $0.00 as possible when we die.

For a very long time, the RMD starting age was 70.5. Then in 2020 it was pushed to age 72 for some people and now it’s been pushed even later.

- RMDs will be required at age 73 for people born between 1951 and 1959.

- RMDs will be required at age 75 for people born 1960 and later.

There are some limited exceptions to these rules, but we won’t address them here. For a full explanation, I recommend the comprehensive summary created by Kitces.com.

So, what does this have to do with charitable giving? Excellent Question!

Many people don’t need their RMDs. They live comfortably on other sources of income, such as pensions and Social Security. Distributions from retirement accounts are often 100% taxable at our highest income tax rate; therefore, many people will choose to live on sources of income with lower tax rates and defer taking RMDs until they absolutely have to. RMDs can be quite large. I’ve seen some in the 6 and 7 -digit range. The only way to avoid this additional income and the associated tax once you reach RMD age is to direct it to charity in the form of a Qualified Charitable Distribution.

Changes to Qualified Charitable Distribution Rules

The SECURE Act 2.0 made one significant change to the Qualified Charitable Distribution rules. A QCD can now be used to fund a Charitable Gift Annuity (GA) or Charitable Remainder Trust (CRT). There is some fine print that you must know.

- Limited to one $50,000 Qualified Distribution to a GA or CRT per lifetime.

- Income beneficiaries of the GA or CRT are limited to the donor OR the donor and their spouse.

- All distributions from the GA or CRT will be taxed as ordinary income.

- Payments from the GA or CRT must begin within 1 year.

- The GA or CRT cannot accept gifts of other assets.

These restrictions mean that it is likely that a donor will use a QCD to create a Gift Annuity, but very unlikely that they will use a QCD to create a Charitable Remainder Trust. Charitable Remainder Trusts are more complex to administer than a Gift Annuity, and thus they come with higher administrative expenses and higher minimum balance requirements. In my experience, it’s not financially feasible to create a CRT with less than $100k and that’s the bare minimum. Otherwise, the administrative fees will eat up too much of the value.

Therefore, when talking to donors about this new opportunity, I would recommend avoiding the CRT option and focus on the GA instead. Make sure they know about how the income will be taxed, that there is no option for income deferral past one year, and the limits on who can be an income beneficiary.

What Stayed the Same?

A Qualified Charitable Distribution can only be made from an Individual Retirement Account (IRA). Our 401(k) and 403(b) accounts are not eligible. Of course, someone could easily transfer money from one of those types of accounts into an IRA and then make their QCD. It’s a fairly simple process that rarely results in any taxes or penalties.

The minimum age to make a Qualified Charitable Distribution is still 70.5. That’s a great thing! Start talking to donors about QCDs early – don’t wait until they reach RMD age. Make sure that they know about the option and the financial benefits it brings. Many donors are using their IRAs to make their annual fund gifts and those gifts are often much larger than what they could afford to give from their checking or savings accounts.

The maximum QCD amount is still \$100,000; however, that amount will now be indexed for inflation.

The Bottom Line…..

The opportunities for Qualified Charitable Distributions have expanded a bit, which gives us the opportunity to communicate something new with donors. If you’re not already doing so, start talking about QCDs. Talk about it in person, in print, in social media, and e-mail.

Let donors know EXACTLY how to make a QCD gift to your organization. Tell them exactly WHO at your organization to contact with questions. Donors will need some specific information from you, so be sure to make it easy to access on your website. They will need:

- Your organization’s legal name,

- Your Federal Tax ID Number,

- Your legal mailing address

How BIG is the QCD Opportunity?

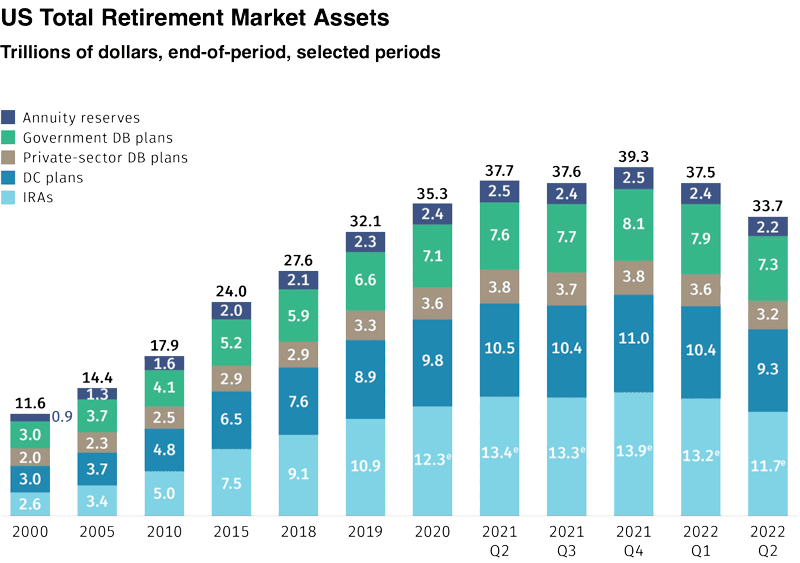

American’s have gotten really good at socking away money for retirement – so much so that it’s often more than they will need to live comfortably. Once they reach RMD age, they will be looking for a way to re-direct that extra money to their favorite causes. Check out this diagram to see how much money has been saved and focus on that IRA segment.

(This image is courtesy of the Investment Company Institute.)

Pro Tip: “DB” stands for “defined benefit”. That’s another way to say “pension”. “DC” stands for “defined contribution”. Those are retirement plans like 401(k)s and 403(b)s.