How to Choose a Guardian in Your Estate Plan

Learn how to choose a guardian in your estate plan to ensure your children’s future is secure. This comprehensive guide covers all aspects of selecting the right guardian.

Home » Estate Planning » Page 2

Learn how to choose a guardian in your estate plan to ensure your children’s future is secure. This comprehensive guide covers all aspects of selecting the right guardian.

Learn how to create a will without legal assistance. This comprehensive guide provides step-by-step instructions to ensure your final wishes are documented and legally binding.

In the realm of estate planning and trust management, the terms “trustor” and “trustee” are often used. However, many people find it challenging to differentiate between these two roles. Both the trustor and trustee play critical parts in the creation and management of a trust, but their responsibilities and functions are distinct. This article aims to clarify the differences between a trustor and a trustee and provide an in-depth understanding of their respective roles.

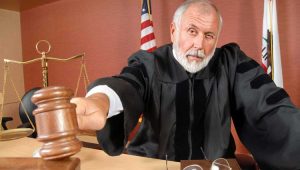

Probate often carries a reputation for being daunting and intricate. However, this essential procedure plays a critical role in ensuring that a loved one’s wishes are honored after they pass away. Gaining a clear understanding of probate can render the process more straightforward and manageable than it initially appears. Unlock the secrets of the probate process with our comprehensive guide. Learn what probate is, when it’s required, and how to navigate it smoothly.

Transparency and building trust rank near the top for values fundraisers must cultivate. With competition for donor dollars increasing year after year, adopting a clear and validated set of professional values will boost donor peace of mind. The Donor Bill of Rights delivers a widely-accepted list of basic expectations between donors and their chosen nonprofits. Consider adopting these guidelines to lend legitimacy to your organization. This document will also help you observe the building blocks for a well-functioning development department.

Thousands of other Americans don’t have a will. Meet with an estate planning attorney, or use our LegacyPlanner™ for free to create a simple, legal will that’s valid in all 50 states.

Live Well … Leave Well. Make a difference even after you’re gone. Plan your estate for those you love and leave a legacy, not a mess.

Did you know that on average, women live five to seven years longer than men? This means any changes in finances, inheritance, or guardianship can complicate the estate planning process. It also means women often spend more time and resources on long-term or end-of-life care.

[An Interview With Viken Mikaelian.] After seeing vendors like Freewill, Nonprofit Docs, LegalZoom and other vendors popularize an online will planning module, it just made sense for us to develop our own. After all, we’re in the planned giving marketing business, and this is just one more way we can help our clients succeed.

It has taken nearly twenty years of persistent lobbying by a handful of key players in the nonprofit sector, and in the end they had to accept some steep compromises, but as of January 1st, if you are age 70-1/2 or older, you can make a direct “rollover” from your traditional IRA into a charitable remainder trust or a gift annuity contract.