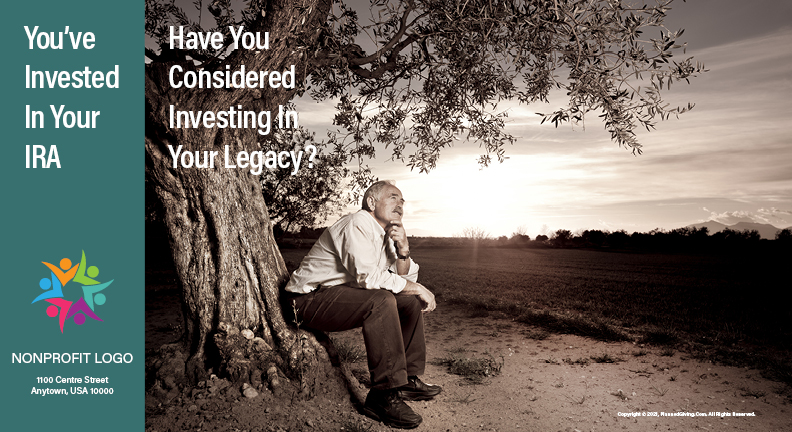

The Great Wealth Transfer is now taking place. Remind your donors about the tax benefits of a gift from an IRA.

We have the language your donors hear.

Imagine the power of a series of such mailings, each with a different donor.

Are you looking for an easier way to bring in more gifts? Do you wish there were a simple, cost-effective way to reach your prospects? Then look no further! We have a powerful solution that will inspire your donors to make generous, meaningful gifts to your organization.

Our tool of choice? A line of clever, eye-catching QCD postcards and brochures that are easy to implement and have a high return on investment.

Aimed at donors concerned about required minimum distributions (RMDs), our QCD marketing pieces explain the benefits of donating from their RMD to a qualified charity:

But here’s the kicker: Now is the perfect time of year to mail them out because of these important RMD deadlines:

When your branded, eye-catching postcard arrives in the mail, they’ll immediately be reminded of the good work you do. And then they’ll discover a simple, mutually beneficial way to help your organization.

Contact one of our planned giving experts today to get started building your endowment.

P.S.

Many retirees worry that once they turn 72, they’ll incur penalties or get stuck with a hefty tax bill because of RMDs. By helping them ease their minds and build their legacy, you’ll also be helping your nonprofit prepare for the future. Don’t wait — it’s the perfect time of year to reach this audience.

The IRA Charitable Rollover provides you with an excellent opportunity to make a gift during your lifetime from an asset that would be subject to multiple levels of taxation if it remained in your taxable estate.

Suppose Jane wants to make a contribution to {nonprofit}. She has $500,000 in her IRA and she wants the contribution to be $20,000. She can authorize the administrator of her IRA to transfer $20,000 to {nonprofit} and $5,000 to herself. The $20,000 distributed to {nonprofit} will not be subject to federal tax and will be counted toward her annual minimum required distribution.

As you plan your required minimum distributions for this year, if you do not need the money the government is requiring you to take, consider using it for a charitable gift using the IRA Charitable Rollover.

H.R. 2029, the Protecting Americans from Tax Hikes Act of 2015 permanently extended the IRA Charitable Rollover. Originally passed in 2006 as part of the Pension Protection Act, the IRA Charitable Rollover allows individuals age 70½ and older to make direct transfers totaling up to $100,000 per year to 501(c)(3) charities, without having to count the transfers as income for federal income tax purposes.

Who qualifies? Individuals who are age 70½ or older at the time of the contribution (you have to wait until 6 months after your 70th birthday to make the transfer).

How much can I transfer? $100,000 per year. The provision no longer has an expiration date.

From what accounts can I make transfers? Transfers must come from your IRAs directly to {nonprofit}. If you have retirement assets in a 401k, 403b etc., you must first roll those funds into an IRA, and then you can direct the IRA administrator to transfer the funds from the IRA directly to {nonprofit}.

To what charities can I make gifts? Tax exempt organizations that are classified as 501(c) (3) charities, including {nonprofit}, to which deductible contributions can be made.

Can I use the IRA Charitable Rollover to fund life-income gifts (charitable gift annuities, charitable remainder trusts, or pooled income funds), donor advised funds or supporting organizations? No, these are not eligible.

How will {nonprofit} count the gift? We will give you full credit for the entire gift amount.

What are the tax implications to me?

Does this transfer qualify as my required minimum distribution? Once you reach age 72, you are required to take required minimum distributions from your retirement plans each year, according to a federal formula. IRA Charitable Rollovers count towards your minimum required distribution from the IRA for the year.

Can my spouse also make an IRA Charitable Rollover, even if we are married and file jointly? Yes, every individual can use the IRA Charitable Rollover for up to $100,000 each year.

How do I know if an IRA Charitable Rollover is right for me? You are at least age 70½, and:

What is the procedure to execute an IRA Charitable Rollover? It is a simple process of alerting {nonprofit} and your administrator of your plan. We offer our sample letter (to administrator) that you can send to initiate the rollover. And ask you to contact us using this sample letter (to charity) so we can verify the check from your IRA administrator.

[SUPPLY SAMPLE LETTERS TO DONOR; DOWNLOAD KIT}

Important: Be sure to check with your financial advisor to determine whether this provision is right for you. This information is not meant as tax or legal advice.

There is a special formula to planned giving marketing that always works.

Are you using it? Here’s our secret.

Many in our industry try to create “breakthrough solutions” which are not economically feasible nor even possible.

They are always reinventing the wheel.

We come up with game-changing content weekly, and it is all based on variable themes that work. Our content library is so vast that our solutions always fit or are easily adapted to what an organization is specifically looking for.

With over 150 fully-developed proven concepts, why waste time and effort creating something that already exists?

This delivers an easier and more effective customized solution versus an off-the-shelf product that sounds canned. No need for endless meetings with your staff, over-working content writers, spending hours trying to brainstorm. We’ve done the work for you and created the language your donors hear.

No stress. No mess. No fuss. Less investment of your time.

We’re dedicated to your success.

All materials are copyrighted. Please respect our work and do not “borrow.” Copying is theft.

Some charities do not qualify for QCDs:

Please reach out. Note: if you give us your mailing address (or PO Box), we’ll send you a complimentary Planned Giving Gift Comparison Chart.